Productivity Traits are genetic traits in seeds that make farmers more productive and are the principal objective of seed company breeding programs. Their role is to increase yields or help the farmers manage the many productivity challenges and costs of farming such as weeds, pests, diseases, or environmental challenges such as wind, drought, or heat. The fundamental need for new Productivity Traits is central to the movement for a more sustainable food supply chain.

Cibus is part of the revolution in breeding called Precision Gene Editing. It is a technological breakthrough in trait development that provides the ability to make genetic changes in a plant that are indistinguishable from conventional breeding or nature in a timebound and predictable manner.

Gene editing technologies such as Cibus’ RTDS technologies and the Trait Machine represents a scale change in trait development that is similar in scale to major technological breakthroughs in other industries such as analogue to digital technologies, transistors, electricity, automobiles, catalytic convertors, or digital photography. In this case, the ability to develop and efficiently deliver complex traits at a fraction of the time and cost of conventional breeding systems.

Cibus’ Trait Machine is a model of the new trait development industry. It is the industry’s first end-to-end gene editing facility. The Trait Machine transforms trait development from a lengthy and random conventional breeding process to a timebound and predictable scientific process. It exponentially changes the time involved in trait development and trait production.

Importantly, the Trait Machine is not intended to be a disruptive technology. Cibus’ customers are the seed companies. We are not a seed company. Our business is to work with the seed companies’ large breeding organizations to fill an important role in their supply chain: to develop and deliver complex traits in their elite germplasm that can improve the productivity of their seeds. The Trait Machine model is central to our vision for the future of breeding:

“High throughput gene editing systems operating as extensions of large breeding operations.”

The Trait Machine has been central in the development of our initial six traits. It will also be central in the further development of our pipeline both to address the major challenges presented by our changing environmental conditions but also to develop a new industry of sustainable ingredients.

Our Pipeline

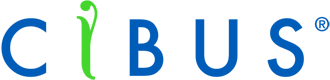

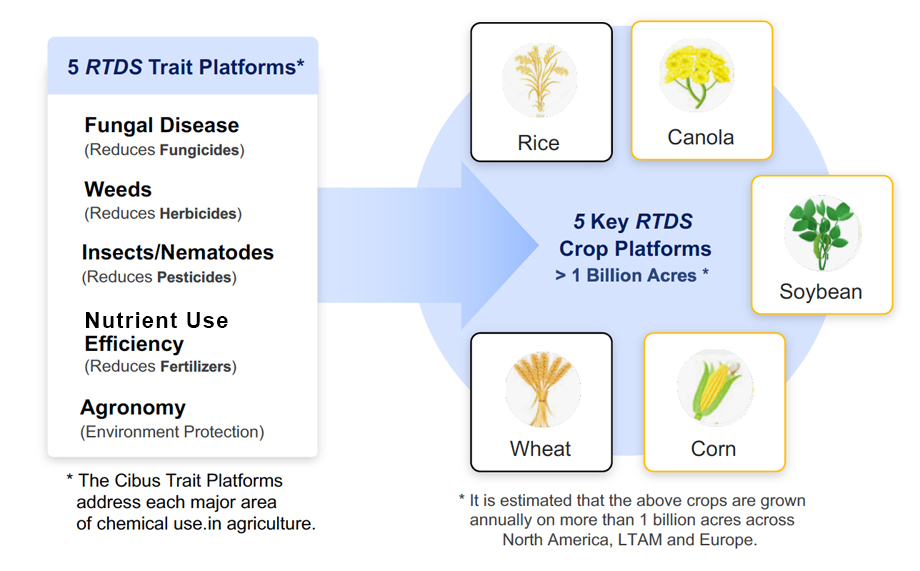

Our Trait pipeline is reflective of our strategic goal to focus on the five major crops and the five key target areas for Productivity Traits: Fungal Disease, Weeds, Pests, Nutrient Use Efficiency and Agronomy. As the environment changes, these are all areas of critical need in addressing farming productivity in our changing environment.

Below is a crop-by-crop summary of our current pipeline, where each of our initial traits are expected to be offered, especially in our initial 3 crops: Canola, Rice and Soybean. In addition, we provide some background on areas of future interest on a crop-by crop basis.

Click each crop to view its specific crop traits.

Canola/Oilseed Rape

Canola was the first crop for which we successfully implemented our RTDS breeding platform and the Trait

Machine Process. Because of this, breakthrough, Canola is the first crop for which we already have built an integrated family of

Productivity Traits for a single crop platform. Our first trait, Pod Shatter Reduction is developed and has begun transferring to

customers. Three other traits in the Canola pipeline for disease, herbicide tolerance and nutrient use efficiency are in advanced development.

Canola/Oilseed Rape is an approximately 46-million-acre market that is split between North America, Europe and Australia.

| Canola Market (Million Acres) |

| North America |

24.0 |

| Europe |

18.0 |

| Australia |

4.5 |

*USDA & FAO 5-year crop mean

2015-2019. Published 2021

Pipeline

Our traits for Pod Shatter Reduction, herbicide tolerance, and disease resistance in our Canola pipeline have been filed and cleared by the

USDA APHIS “Am I Regulated” process (https://www.aphis.usda.gov/aphis/ourfocus/biotechnology/am-i-regulated)

and will be regulated in the US as products from traditional breeding. The successful development and transfer of these first traits

to our customers, the first of which occurred in Q1 2023, as described below, will be an important milestone in the gene editing industry.

It will also be a major commercial milestone in the growth of Cibus.

Pod Shatter Reduction (PSR) - Transferring

PSR is our lead Cibus Powered™ trait product. We made the first transfers of a customer’s elite germplasm with the edited PSR trait in

Q1 2023. We expect to transfer the PSR Trait in the elite germplasm to up to 6 companies in 2023.

Herbicide Tolerance

We have initiated editing our herbicide resistance trait in Canola (HT2) with greenhouse trait confirmation ongoing.

Disease Resistance

We are very encouraged by our initial field trials for our initial mode of action for Sclerotinia (white mold) resistance in Canola

and winter oilseed rape. Green house trait confirmation and field work for the additional modes of action are ongoing. This trait is particularly

important because, if successful, we believe it will be the first commercially available gene edited trait for disease in any crop.

Nutrient Use Efficiency

We have licensed in initial traits for nitrogen use efficiency in Canola and we expect to initiate the editing process in Canola by the end of 2023.

Rice

Rice is the second crop for which we successfully implemented our RTDS breeding platform and Trait Machine process.

It is an important crop for gene editing because it is one of the many major crops for which there were no GMO traits. We believe that our work

in developing a RTDS cell biology platform for Rice is transformational and will enable us to soon have a full pipeline of productivity traits in Rice.

In North America, South America and Europe, Rice has an approximately 11-million-acre market. Although a relatively small crop in terms of acres,

the expected trait fees can be larger due to the increased input costs per acre and subsequent cost savings.

| Rice Market (Million Acres) |

| North America |

3.0 |

| South America |

7.0 |

| Europe |

1.0 |

*USDA & FAO 5-year crop mean

2015-2019. Published 2021

Pipeline

Our traits for herbicide tolerance and disease resistance traits in our Rice pipeline have been filed and cleared by USDA APHIS

“Am I Regulated” process (https://www.aphis.usda.gov/aphis/ourfocus/biotechnology/am-i-regulated)

and will be regulated in the US as products from traditional breeding. The successful development and transfer of these first traits to our customers,

the first of which occurred in Q2 2023, as described below, will be an important milestone in the gene editing industry. It will also be a major

commercial milestone in the growth of Cibus.

Herbicide Tolerance- Transferring

In April 2023, we transferred our two herbicide traits in Rice to a customer in their elite germplasm for commercial development.

We expect initial launch of at least one of these traits in the next 2-3 years.

Nutrient Use Efficiency

As pressure on the use of fertilizers increases developing traits for nutrient use efficiency becomes increasingly important. We have initiated

the editing process for our initial mode of action. We expect Nutrient Use Efficiency to comprise multiple modes of action. We will update as we progress on this important target.

Disease Resistance

Disease resistance is an incredibly important need for Rice farmers that may avoid multiple fungicide applications per year. It is a key target of our trait development plans.

Soybean

We are in final stages of completing our RTDS® breeding platform and Trait Machine process for Soybean.

We expect to have a Soybean Platform by H2 2023. Once established, we will start the development process in collaboration with our

collaboration partner, GDM, for our family of gene edited traits in Soybean. We plan to lead with the development of a disease resistance

and an herbicide tolerance trait similar to the traits being developed in our Canola pipeline. In addition, in Soybean we are planning

a trait for nematode resistance. This is a much-needed trait for Soybean for which there are currently no alternatives other than chemicals.

In North America and South America, Soybean is an approximately 200-million-acre market. Soybean with corn have been crops that have been the

largest users of GMO traits in their major markets. Approximately, 95% of the soybean crops in North America and South America have GM Traits.

Trait Fees for these crops can range from $5 per acre to as much as $30 per acre. In each case, the Trait Fee is commensurate with the cost

savings realized by the farmer. With 200 million accessible acres for its traits, this is a very large and important crop for Cibus.

| Soybean Market (Million Acres) |

| North America |

90.0 |

| South America |

98.0 |

| Europe |

2.0 |

*USDA & FAO 5-year crop mean

2015-2019. Published 2021

Pipeline

Our traits for herbicide tolerance and disease resistance traits in our Soybean pipeline have been filed and cleared by USDA APHIS “Am I Regulated” process.

(https://www.aphis.usda.gov/aphis/ourfocus/biotechnology/am-i-regulated)

and will be regulated in the US as products from traditional breeding. The successful development and transfer of these first traits to our customers will be an

important milestone in the gene editing industry. It will also be a major commercial milestone in the growth of Cibus.

Herbicide Tolerance

OOur herbicide resistance trait for Soybean is the same herbicide resistance trait we are developing in Canola. We have initiated editing this herbicide

resistance trait (HT2) in Canola with greenhouse trait confirmation ongoing. We expect to initiate editing for this HT trait in

Soybean as soon as our Soybean platform is developed.

Disease Resistance

We are very encouraged by our initial field trials for our initial trait for Sclerotinia (white mold) resistance in Canola and winter Oilseed Rape.

We expect to initiate editing our Sclerotinia trait in Soybean as soon as our Soybean platform is developed.

Nematode Resistance

Soybean Cyst Nematode is an incredibly damaging pest of Soybean in most Soybean growing areas of the America’s that is capable of

reducing yields dramatically. It is a key target of our trait development plans.

Wheat

We expect to have our RTDS breeding platform in Wheat developed by the end of 2024. Once established,

we expect to develop a family of traits for Wheat focusing initially on disease resistance and nutrient use efficiency. Nutrient

use efficiency is a need in many crops, but particularly in the large acreage crops like Wheat and Corn, it has the potential to

materially reduce the carbon footprint of the crop while offering better yield with similar fertilization. Fungal diseases cause

a significant economic impact in Wheat production. We are encouraged that we will be able to address the major diseases in Wheat.

Although it is grown on over 200,000 acres in North America, South America and Europe, we consider Wheat to be an approximately

82-million-acre market. Like Rice, it has never had GM traits. As we get closer to being operational on our Wheat Trait Machine Platform,

we will provide more detail on the initial pipeline.

| Wheat Market (Million Acres) |

| North America |

36.0 |

| South America |

13.0 |

| Europe |

33.0 |

*USDA & FAO 5-year crop mean

2015-2019. Published 2021

Corn

We expect to have our RTDS breeding and Trait Machine platform in Corn developed by the end of 2025.

Once established, we expect to develop a family of traits for corn focusing initially on nutrient use efficiency, disease and

herbicide tolerance. Nutrient use efficiency is a need in many crops, but particularly in the large acreage crops like Wheat

and Corn which have the potential to materially reduce the crop’s carbon footprint while offering better yield with similar fertilization.

Fungal diseases cause significant economic losses in Corn. We are encouraged that we will be able to also address major diseases in Corn.

In North America, South America and Europe, Corn is an approximately 212-million-acre market. It is a huge market with immense opportunity.

As we get closer to being operational on our Corn Trait Machine Platform, we will provide more detail on the initial pipeline.

| Corn Market (Million Acres) |

| North America |

90.0 |

| South America |

75.0 |

| Europe |

47.0 |

*USDA & FAO 5-year crop mean

2015-2019. Published 2021